By Bian Scanlan Executive Advisor Edgewater Capital Managing Partner Freedom Bioscience Partners

This is a heavily abridged article from De Facto’s 2025 BioBeat Report [previously branded as the CPHI Annual Report] — one of the industry’s most trusted barometers of innovation and investment trends. Below is a summary of just some of the findings.

Introduction

At CPHI 2024, the mood was cautiously optimistic as the post-COVID CDMO recession was finally loosening its grip. This year has brought a mix of macroeconomic recovery and geopolitical curveballs:

U.S. tariffs, executive orders, FDA shakeups, and NIH funding cuts. The rules have changed—and they’re still changing.

Yet amid the chaos, some CDMOs are thriving. The winners? Those aligned with an uneven pharma funding landscape, equipped for specialized solutions, and agile enough to navigate global headwinds.

This report dives into the forces reshaping the CDMO landscape in 2025—from funding and AI disruption to regulatory changes, therapeutic trends, and the rise of China’s drug innovation engine. Let’s unpack what’s driving the sector—and where it’s headed.

Pharma funding: The lifeblood of CDMO growth

Funding is the fuel behind CDMO demand—and 2025 has been a mixed bag.

Highlights:

- Biotech Funding Uneven and Focused more on Clinical Assets

- Biotech VC’s are not raising money—down 92% YoY (Pitchbook)

- Biopharma IPOs remain muted; Q2 saw zero S.

IPOs for the first time since 2016

- Public biotech valuations are still depressed, though the XBI index has rebounded 40% since April

- Pharma M&A and licensing are stepping in to fill the gap

- AI drawing investors away from Biotech – for now.

Total biotech funding

Given the impact smaller pharma is having on new therapeutic development, it is important that the funding environment is healthy. At last year’s CPHI, we noted a generally improving picture here overall. One year later, funding has, in fact, leveled out due to a number of factors, including lingering uncertainty with global geopolitical and macroeconomic conditions, and an underperforming funding and M&A climate. So how is Pharma M&A and Licensing doing?

M&A and licensing: Pharma’s strategic lifeline

With funding lagging and IPOs stalled, biotechs are turning to M&A and Licensing deals —and big pharma is responding.

Highlights:

- 30+ M&A deals over $50M logged through September (Biopharma Dive)

- Total M&A value is up, despite only two mega- deals (Merck–Verona, J&J– Intercellular) and weighted towards early-stage assets

- Licensing activity is robust and weighted towards clinical assets in 2025

- Over 30% of global licensing deals in 2025 involved China HQ’d sellers

- China deals account for 40%+ of total upfront licensing value

- Modalities in highest demand: biologics, small molecules, and RNAi (nucleic acid therapeutics)

Big Pharma licensing

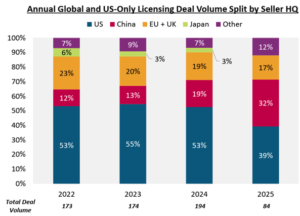

For licensing deals, big pharma has been active globally (Figure 1), and 2025 will be at least on par with 2024 (194) which saw significant gains over 2022 (173) and 2023 (174).

For licensing deals, big pharma has been active globally (Figure 1), and 2025 will be at least on par with 2024 (194) which saw significant gains over 2022 (173) and 2023 (174).

Noteworthy is the surge in licensing of assets from China HQ’d biotechs, which accounts for over 30% of all activity in 2025, and over 40% in terms of licensing value (up front). More on China to come in the upcoming spotlight section.

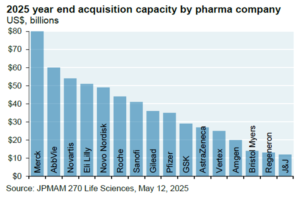

As macroeconomic and geopolitical uncertainties become clearer, it is likely M&A and Licensing will accelerate given the large war chest of available M&A capacity at big pharma (Figure 2).

As macroeconomic and geopolitical uncertainties become clearer, it is likely M&A and Licensing will accelerate given the large war chest of available M&A capacity at big pharma (Figure 2).

Where is demand for CDMO services

Pharma funding is flowing out into the CDMO sector, particularly in certain segments. Let’s explore where the funding and demand is greatest, and where it is still lagging.

Strength in Commercial Manufacturing

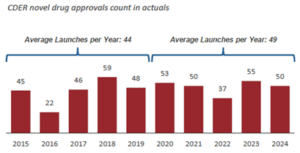

Global CDMO commercial manufacturing demand remains stable, tracking pharma sector growth (~6% CAGR through 2030). Sustained expansion depends on new drug launches. As of September 2025, 30 novel drugs have been approved, projecting ~40 for the year. (Figure 3). CBER lags with 8 approvals YTD (~11 annualized) versus 16 in 2024. The slowdown may also reflect FDA staffing cuts or other factors—worth monitoring in 2026.

Global CDMO commercial manufacturing demand remains stable, tracking pharma sector growth (~6% CAGR through 2030). Sustained expansion depends on new drug launches. As of September 2025, 30 novel drugs have been approved, projecting ~40 for the year. (Figure 3). CBER lags with 8 approvals YTD (~11 annualized) versus 16 in 2024. The slowdown may also reflect FDA staffing cuts or other factors—worth monitoring in 2026.

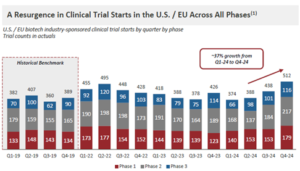

Strength in Clinical Trial Materials Continues

Those CDMO’s focused predominantly in clinical and commercial phase services have done better in 2025 and looking ahead clinical trial starts are a strong barometer for where CDMO demand is headed (Figure 4). Note the strength of Phase 1 trial starts. We have heard some concern over the past year that the drought in early-stage biopharma funding may cause a temporary pause in Phase 1 starts, which could ripple

Those CDMO’s focused predominantly in clinical and commercial phase services have done better in 2025 and looking ahead clinical trial starts are a strong barometer for where CDMO demand is headed (Figure 4). Note the strength of Phase 1 trial starts. We have heard some concern over the past year that the drought in early-stage biopharma funding may cause a temporary pause in Phase 1 starts, which could ripple

through clinical development in the years to come. While this may still be possible, it is encouraging for CDMO’s focused on clinical activities that overall demand should remain stable, and we envisage a further return to more robust growth over the next year.

“Most favored nation” drug pricing – Putting pressure on margins?

In May, the administration proposed a “Most Favored Nation” drug pricing policy, which aims to cap U.S. drug prices at levels charged in peer countries—likely lowering U.S. prices while raising them abroad. In July, 17 major pharma companies were asked to comply by September 29, though the policy remains unimplemented as of October. If enacted, it could squeeze pharma margins, prompting renegotiation of CDMO contracts and driving CDMOs to prioritize efficiency or shift toward higher-margin, complex therapies.

China spotlight: From strategic partner to strategic threat?

China’s CDMO dominance is well known—but its innovative pharma ecosystem is now surging:

- 30% of global clinical trial activity in 2024 came from China HQ’d sponsors

- 83% of Chinese trials are conducted domestically

- China leads in infectious disease and oncology trial volume

- Licensing deals with Western pharma are accelerating—especially for early-stage asset

China’s biotech ecosystem is evolving rapidly, mirroring its CDMO ascent.

With growing R&D output and global dealmaking, China is challenging the U.S.’s long-held biotech leadership—reshaping CDMO dynamics and global supply chain strategies.

China’s rapid rise in both CDMO and biotech innovation has prompted the US and some Western countries to elevate biotechnology to a national security priority, and many are asking, “Is China a strong strategic partner, or a strategic threat?”. These debates are at the heart of the massive global supply chain realignment ongoing right now. Let’s take a closer look at the data.

Clinical Trial Starts

Looking at clinical trial starts (by sponsor headquarters location) reveals how much China has quietly grown

in its overall contribution to drug development over the past five years. In 2024, China-headquartered companies accounted for 30% of all trial activity which is only marginally below the US. Interestingly, while US- headquartered companies have held a relatively steady share of the clinical trials over the past five years, EU companies have dropped their share by nearly 50%.

Novel Drugs in Development

Novel Drugs in Development

Mirroring the clinical trial activity are the number of compounds in development that have originated by China-headquartered companies (Figure 5).

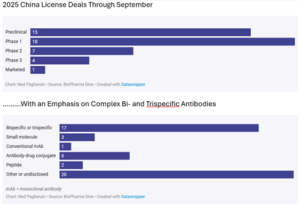

Licensing Deals

Coinciding with the increased number of drugs in development, Chineseinnovators are increasingly doing licensing deals with US and EU-based pharma companies; a trend which has accelerated, and in 2025 nearly 30% of all big pharma licensing activity was with China-based innovators. Interestingly, most of the licensing activity has been centered around Pre-clinical and Phase 1 assets (Figure 6), as Western pharma companies look to lower costs and regulatory speed to bolster their early-stage pipelines. China’s biotechs have been able to move very fast to get concepts to a licensable stage.

Coinciding with the increased number of drugs in development, Chineseinnovators are increasingly doing licensing deals with US and EU-based pharma companies; a trend which has accelerated, and in 2025 nearly 30% of all big pharma licensing activity was with China-based innovators. Interestingly, most of the licensing activity has been centered around Pre-clinical and Phase 1 assets (Figure 6), as Western pharma companies look to lower costs and regulatory speed to bolster their early-stage pipelines. China’s biotechs have been able to move very fast to get concepts to a licensable stage.

Implications for CDMO’s

Important implications here for regional CRO’s and CDMO’s where Chinese firms stand to gain from both increased China-based innovation and continuing Western-based business albeit at some reduced level. US/EU and Indian CDMO’s will see more demand from US and EU headquartered innovators, with Western CDMO’s potentially feeling more pricing pressures due to drug pricing reforms, while Indian CDMO’s will hold more pricing leverage and should emerge well-positioned.

The M&A climate and CDMO valuations

The CDMO M&A landscape in 2025 has been somewhat active, though still muted compared to historical peaks. The headline CDMO transaction was Bain’s $10 billion acquisition of PCI Pharma Services, underscoring investor interest in scaled platforms. More broadly, however, the market remains soft, with pitch volume uneven across pharma services investment banks—some reporting strong pipelines while others see limited activity.

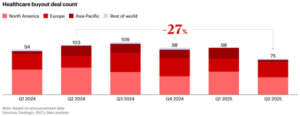

Behind the scenes, several larger CDMOs may be evaluating strategic options, suggesting that late 2025 and into 2026 could bring an acceleration of mid- to large-scale transactions in the $500 million to $1 billion-plus range. This potential wave of consolidation comes against a backdrop of broader softness in healthcare buyouts, which fell 27% year-over-year in Q2 2025 (Figure 7). Policy and macro factors are shaping regional dynamics. According to Bain, tariffs and shifting regulatory environments have dampened dealmaking in the U.S. and APAC, while Europe has emerged as a relative bright spot. The EU not only posted a year-over-year increase in deal count but also outpaced Q1 2025 activity, highlighting its resilience.

Behind the scenes, several larger CDMOs may be evaluating strategic options, suggesting that late 2025 and into 2026 could bring an acceleration of mid- to large-scale transactions in the $500 million to $1 billion-plus range. This potential wave of consolidation comes against a backdrop of broader softness in healthcare buyouts, which fell 27% year-over-year in Q2 2025 (Figure 7). Policy and macro factors are shaping regional dynamics. According to Bain, tariffs and shifting regulatory environments have dampened dealmaking in the U.S. and APAC, while Europe has emerged as a relative bright spot. The EU not only posted a year-over-year increase in deal count but also outpaced Q1 2025 activity, highlighting its resilience.

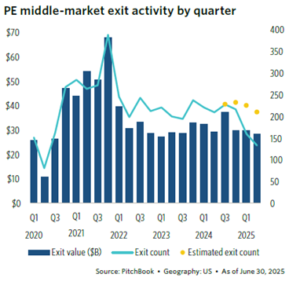

PE exit activity remains slow (Figure 8), while portfolios continue to rise as new transactions continue (Figure 9).

PE exit activity remains slow (Figure 8), while portfolios continue to rise as new transactions continue (Figure 9).

Nearly two-thirds of PE portfolios have been held for over four years, and over one-third have hold periods of greater than seven years. Consequently, the pressure is mounting for deal activity to accelerate over the next year.

Pharma services valuations

CRO and CDMO valuations have modulated a little since last year’s CPHI, however, they remain at historically attractive levels (Figure 10).

Outlook for the CDMO sector in 2026

The CDMO business has shown surprising resilience in the midst of several years of constantly changing macroeconomic and geopolitical challenges, and 2025 is no exception. Just as the challenges faced during (and after) covid subsided, a new pharmaceutical world order is underway that could reshape the face of regional supply chains and the CDMO landscape. In spite of this, demand for CDMO services in 2026 will likely see moderate (mid- single digit) growth overall, but it will be felt unevenly. To the right is a qualitative assessment of the areas of growth and caution.

CDMO’s – Five key takeaways in 2026

Specialization over scale – GLP-1’s aside, scale is giving way to specialization as diverse therapeutic modalities create complexity and

opportunity. CDMOs that differentiate through technology, equipment, and analytical expertise—particularly in areas like RNAi, ADCs, PROTACs, and multi-specific antibodies— will be well positioned. Predictive data science in biologics and formulation development is also emerging as a high-value capability and likely M&A target. Smaller CDMOs may even hold an edge in niche specialization.

Recovery with volatility – The recovery in demand continues but remains fragile amid geopolitical and regulatory uncertainty, with funding softness and slow client decision-making likely to weigh on 2026. Still, the industry’s resilience suggests gradual improvement. Early-stage CRO/CDMO demand should accelerate by mid-2026 as big pharma M&A and Licensing increasingly targets preclinical assets and broader funding markets rebound.

US CDMO’s see more consistent reshoring demand – In the U.S., tariffs and executive orders are driving supply chain reshoring. While full transitions will take years, near-term CDMO “bridge” deals are expected, with Samsung Biologics already securing nearly $2B in U.S. big pharma contracts through 2029. Domestic CDMOs should also see steadier demand from emerging and mid-sized pharma. Generally, questions remain around shortages in technical talent given the added demand and infrastructure expected.

Continue driving operational efficiencies – CDMO’s will need to continue driving operational efficiencies to keep profit potential higher, especially during periods of lower or choppy demand. This is especially true for US and EU-based CDMO’s who may feel more of a pricing pinch from customers given structural drug pricing changes. Adoption and deployment of AI tools for back office, sales/ marketing, quality, and operations will be critical over the coming year. Beyond that, AI to enhance process development will also take on a growing importance.

CDMO M&A accelerates in 2026 – As demand continues to recover, so will CDMO performance, thus driving more exit activity for PE’s with portfolios that are bursting at the seams. The leading indicator will be investment bank pitch volume, and while we are observing a mixed bag today, there are indications of positive movement here, particularly among the mid/large cap CDMO’s in the $500M->$1Bn range.